How does credit work?

An economy, as explained in the previous post named economy, money, and inflation, is nothing but a system that exchanges goods and services and uses the money to quantify, exchange and store their value.

But there is something called 'credit' that makes things interesting.

But before we go there, let's return to reaffirm how a society gets a better standard of living over time. We get a better standard of living by efficiently producing more goods and services through better processes and technological innovations. So, society's improvement in productivity makes things better, irrespective of whether there is credit in the system or not.

So, why do we need credit?

What if we could increase society's true productivity in the long term by having people or economic entities borrow from each other and then return it later under a financial system? But that borrowing may not be free and will come at a cost for the borrower called an 'interest' which is to be paid within a timeframe as decided by the borrower and the lender.

The concept of credit helps both the borrower and the lender. The borrower gets a sum of money (economic value) in an earlier time frame so that they can invest or spend it at the time when it's required the most and can be optimally utilized. For the lender, it helps to use the extra cash to earn some 'interest' and grow their wealth over time.

For example, if the carpenter in our previous example wants to get raw materials like wood and nails but he has no money yet, he can borrow from someone. Then he can build the table, sell it and return the money equivalent for that raw material along with interest to the lender. Here, interest is the additional cost he had to pay because of this system, apart from the raw materials. But had he not got that credit, he could have lost the opportunity to build a table and get subsequent profits out of it.

This is how credit has the potential to improve someone's productivity. However, if he had not made enough from the table, it would have been difficult to pay back the interest. Or worse, he could have spent that money on personal things which did not have any relevance to making tables.

On the other side, the lender had to take the 'risk' of the carpenter not paying the money back. So, essentially if the lender finds an interest rate (for example, 5%) that is not too high nor too low, it can give him the highest returns (interest) with the minimum risk. Though, that optimum value is hard to find in a complex system.

But if the system runs well, it improves overall efficiency, and everybody benefits. Actual productivity is better off, and everyone's standard of living gets relatively better over time.

Credit inherently brings cycles with it, fortunately, or unfortunately.

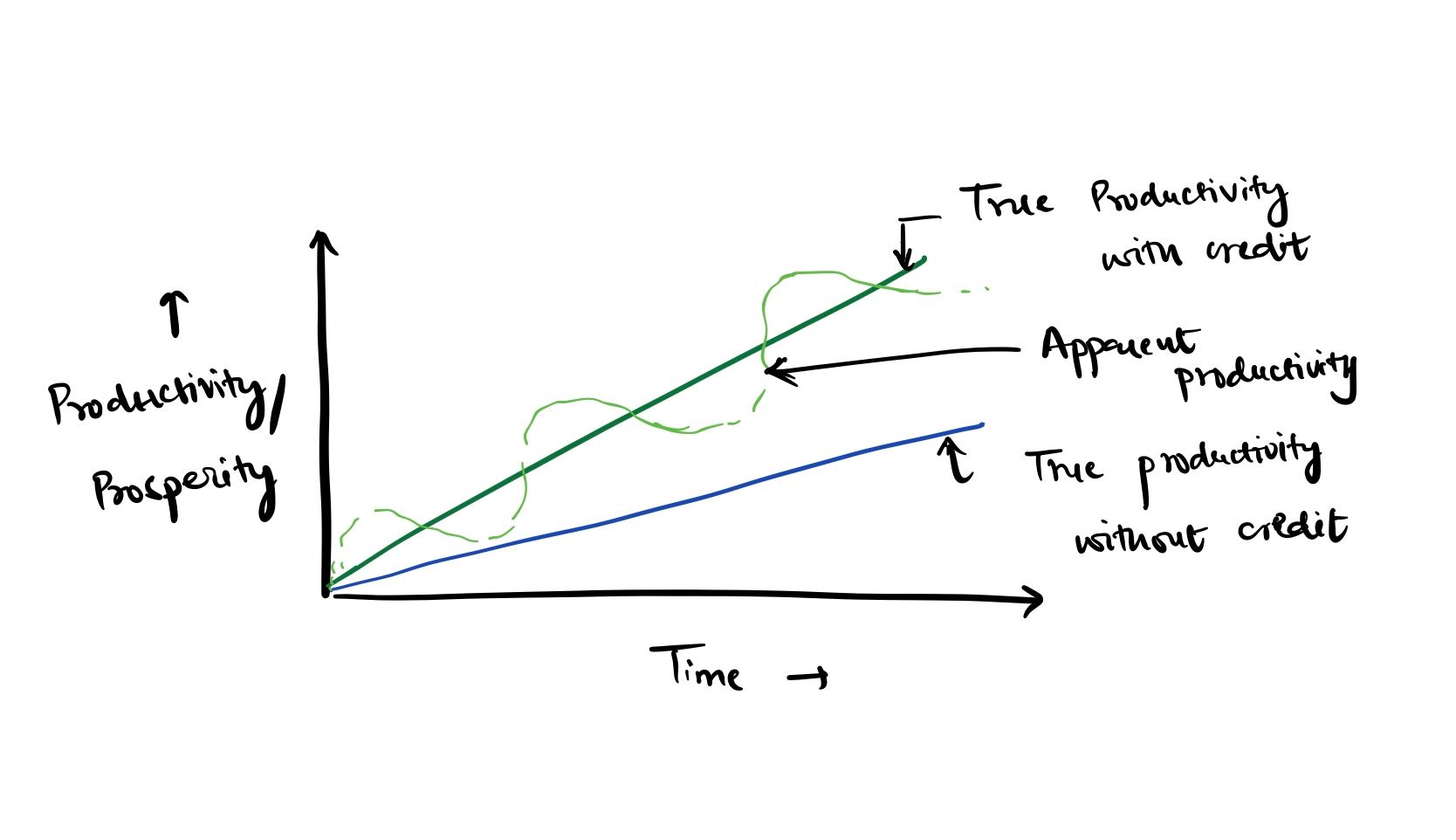

As you can see, although credit brings ups and downs in the market, income levels, and employment opportunities known as credit booms and busts (recessions), it helps increase true productivity and prosperity of the society in the long term.

The cycles are of two types, i.e., short-term ranging from 8-10 years and long-term ranging from 75-100 years, as mentioned by Ray Dalio in his book Principles of The Changing World Order.

So, the economists try to manage these cycles to balance economic growth and inflation. The government of a country and the central bank of a country plays a central role in both. Other forces, such as currency exchange rate, commodity prices, etc., influence the economy.

How do governments and central banks influence economy ?

The government influences the economy by increasing or decreasing government spending, which is called the fiscal policy. It can be effective if the government has enough resources to influence the economy at scale. Simply if they spend more, it boosts some businesses, which in turn kicks off the economic cycle. But they have to spend responsibly to manage their resources. We'll discuss more about taxes and spending in the next article.

The central bank, such as FED in the USA or RBI in India, influences the economy through monetary policy, which essentially refers to

- Increasing or decreasing the interest rates (repo rate) - basically refers to the cost of credit available to individuals and businesses. The cost at which for example the carpenter got the credit to build his table would affect his output and profits.

If the interest rate is low, banks lend easily and at a cheaper rate which helps in increasing economic activity, but at the same time it can also increase inflation in the system. In the worst case, it can lead to hyperinflation, which leads to currency devaluation and other cascading effects. For example, Venezuela and Zimbabwe have gone through hyperinflations ruining their economy.

On the contrary, decreasing the interest rates limit economic activity and helps reduce inflation. Recessions are caused if the economic activity is too low, which leads to reduced income, unemployment, and deflation. In extreme cases, it can lead to a depression which is a severe and longer form of a recession, such as the 1929-1932's Great Recession in the USA.

So, it's more like a goldilocks situation where central banks try to figure out the optimum interest rate for a country at a particular time and to keep updating it as per the needs. Central banks are independent of this; however, they consult the government for the same.

2. Increasing the money supply (i.e., printing money) - When economic growth is not getting stimulated enough by decreasing interest rates, central banks tend to increase the money supply, a.k.a by printing money (now digitally).

As explained in the previous article, this approach is inflationary since the goods and services remain constant while the total amount of money being circulated increases. This approach is usually adopted during economic downturns such as the Coronavirus pandemic when the FED, the central bank of the USA, printed trillions of dollars and caused inflation not just in the USA but worldwide ( because the US $ is the world reserve currency).

So essentially, government and central banks control the economy using 'credit' which creates economic cycles.

In the next article, we'll discuss what taxes are and the effect of tax rates on an economy, which is another tool that the government has to control the economy and it's own source of funds.

You can subscribe to be notified of the next article and other cool stuff.

Member discussion