Economy, money and inflation

Economy refers to a system in which goods and services are produced and exchanged with the help of people and resources. Goods can be thought of as something tangible like a table, car, or smartphone. Service however is an act of labor or service by one person or company to another.

A small town may have a carpenter using resources like wood and hammer along with his time and effort to produce a table. So, a good would be produced as the final outcome.

Whereas a service could be for example getting a haircut from a local barber. The barber spent time and effort to deliver an end result that served someone's need.

If goods and services are valuable someone might exchange them with something they have got or it's equivalent.

And so in an economy, there are contributors which participate in the production of goods and services. So if everyone collectively produced more, everyone would be better off than earlier i.e. getting a better standard of living. It can be referred to as increasing the economic pie.

A fair economic system rewards people based on the quantity and quality of economic output (goods and services). And this is what results in economic heirarchy in the system where some are better off than others. This can be referred to as the division of the economic pie based on economic output and their capabilities.

However, it could be that everyone contributes because of various reasons. Someone may be diseased, too old, too young, incapable, or simply unwilling to participate. And so the economic society may decide to divide the economic pie based on the needs of different individuals and not just based on their economic output. It can be referred to as the redistribution of the economic pie based on needs. That's where governments come in where they promise to redistribute in a fair way while making sure that the economic pie keeps growing reasonably well.

The only way to increase the economic pie which in turn results in having a better standard of living is by increasing true productivity of the society i.e. quantity and quality of goods and services produced.

The Standard of living for a society increases by

- Increasing the number of economic contributors i.e. working population

- Increasing the quantity and quality of economic output by each contributor i.e. productivity

- Making the system and means of production more efficient (often through technological innovation and better management)

Although there is something like credit that might help in the short run, it's only the true productivity of a society that makes lives better for everyone.

Money

We established that the only way to better lives and increase prosperity in the long term is by increasing real productivity and economic output. But we also need a way to quantify, exchange and store everyone's economic output. That's where the concept of money comes into the picture which can be of any form but essentially has the following properties

- Unit of measurement (to quantify economic output)

- Medium of exchange

- Storehold of wealth

For example, if the carpenter mentioned earlier wants to exchange the table with the barber for a haircut, there has to be a common measurement unit to quantify both the table and the haircut. But what if a table is much more valuable than a single haircut needed by the carpenter? Then the difference in economic value has to be transferred in the form of a store hold of wealth (claim on future economic output) and be easily exchangeable. We can't just barter every time.

Money can be of any form. It just needs to be accepted throughout that economic system and hold the above properties. It could be flower petals. It could be silver or gold coins. It could be paper money. Historically, the money itself should have some intrinsic value (or be backed by something that does) and be of limited supply to maintain its value. And different economic systems may have different forms of money called currencies.

For example, currently, the US Dollar is widely recognized as currency throughout the world making it a reserve currency. Currently, all global currencies are tied by the dollar. Although the United States central bank controls the dollar, it affects everyone in the world!

Inflation (and deflation)

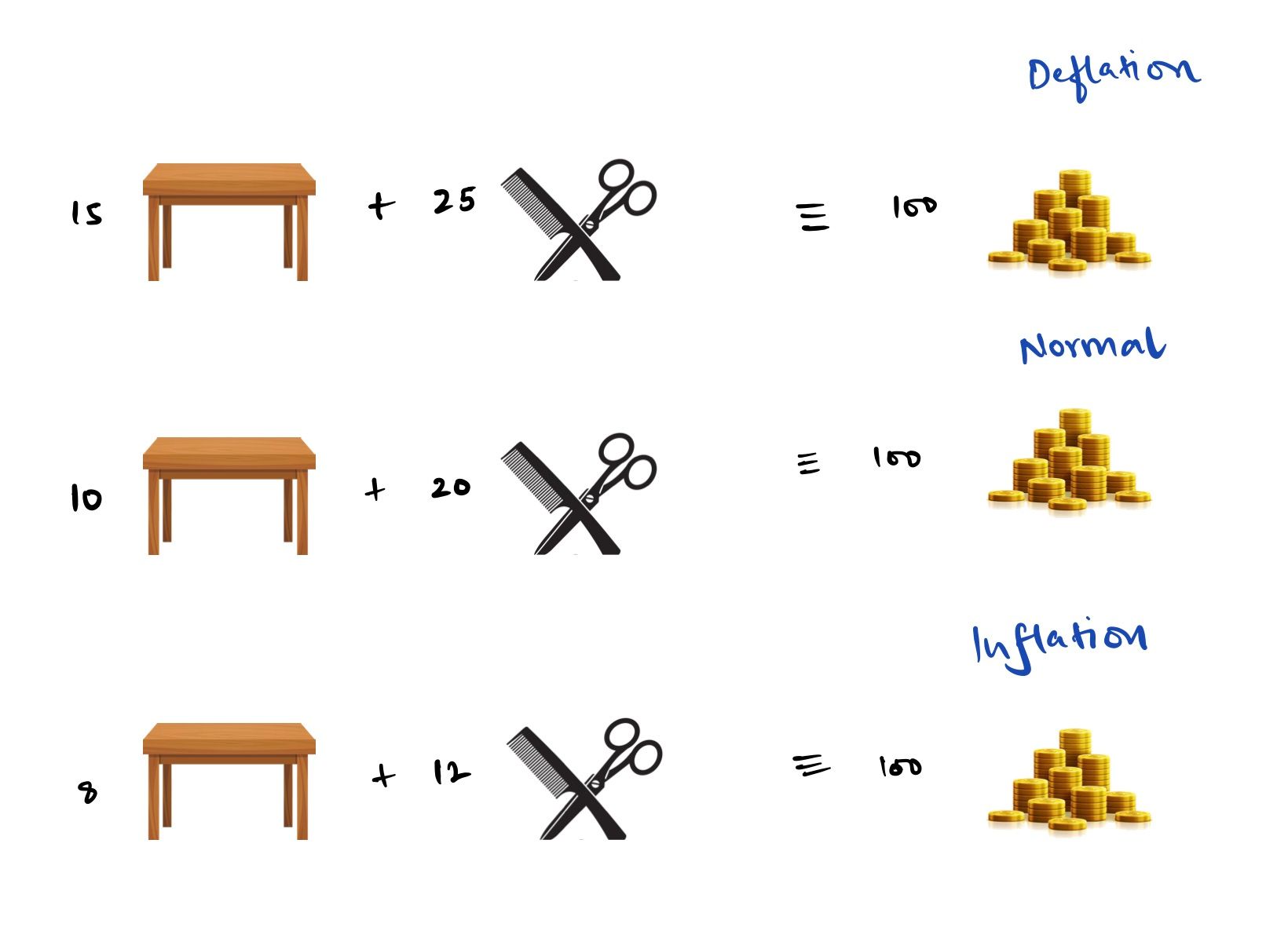

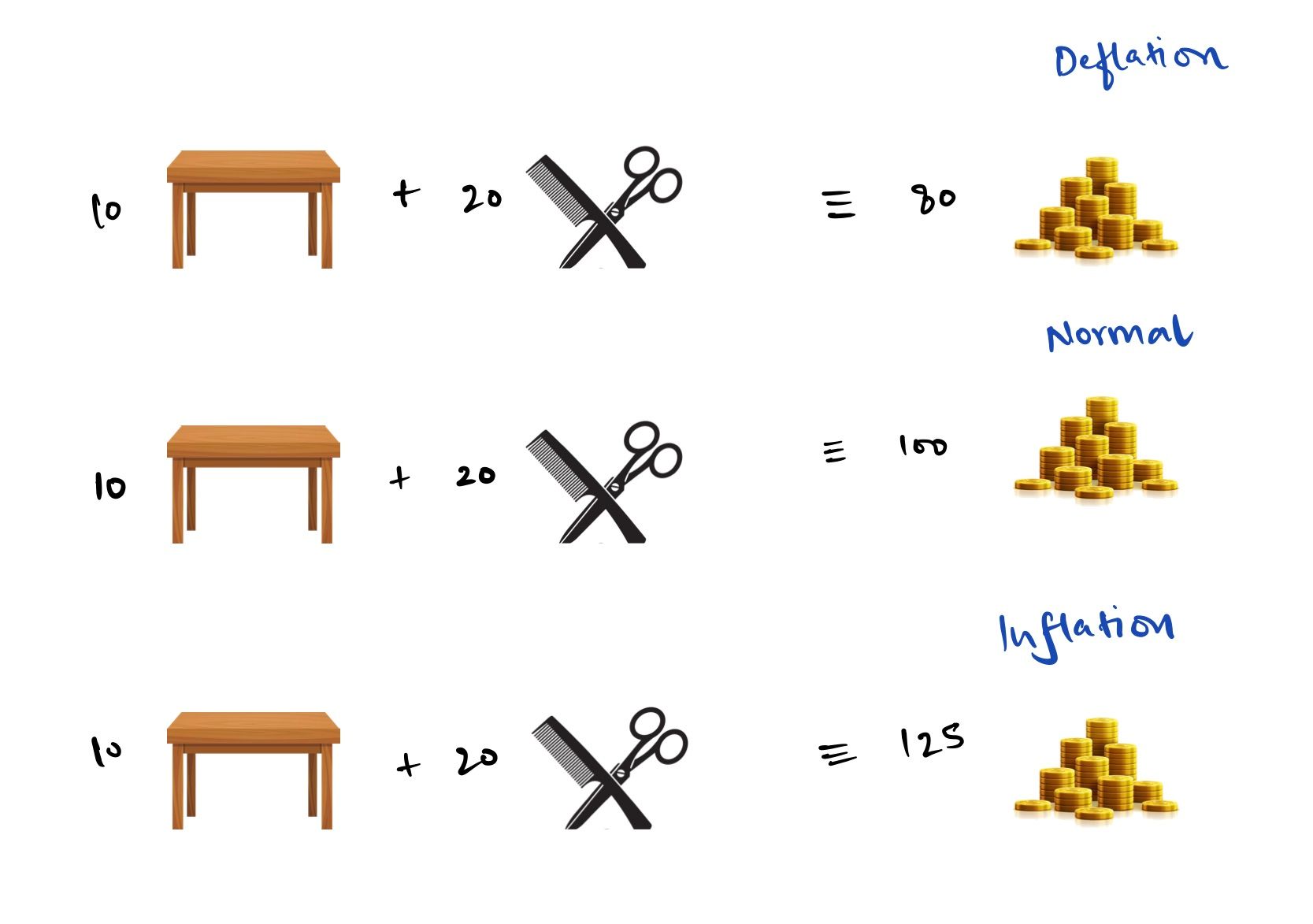

So, an economy in nutshell produces some economic output (goods and services) and has some monetary equivalent for it. Now let's say in an economy we only have 10 tables and 20 haircuts and the total equivalent money supply is 100 gold coins (simplistic example). We can calculate the price of a table and a haircut in terms of gold coins based on their amount, the difference in their values, and the number of total gold coins available.

If we increase the number of tables to 15 and the number of haircuts to 25 for the same total of 100 gold coins, intuitively we can see that price for a single table or haircut will reduce. This is called deflation i.e. the prices have deflated or decreased since the supply of goods and services has increased while the money supply is the same.

In another situation, if the number of tables and haircuts produced goes down for the same 100 gold coins then prices will go up. This is called inflation.

However, inflation and deflation can also happen for the initial economic output of 10 tables and 20 haircuts. That can happen if we increase or decrease the number of gold coins present in the economic system. This is called changing the money supply in the system. Mostly it's done through a central authority like a central bank.

For example, in the real world, if we increase the total number of dollar notes (money supply) in the United States (economic system), then the prices of economic output will increase (inflation). And vice versa.

It could be that both economic output and money supply may increase and so in that case whichever increases faster would result in a corresponding inflationary or deflationary effect.

So, inflation or deflation can be caused by either a change in economic output or a change in the money supply.

So, we talked about a simple economic system where goods and services are produced and their value is measured, exchanged, and stored using money. We can introduce something like credit to make this system more interesting and hopefully more effective.

Credit, government spending, and taxes with their respective effects would be covered in the following article.

You can subscribe to be notified for the same.

Member discussion